Benefit In Kind Malaysia 2019 Car

These benefits are called benefits in kind bik.

Benefit in kind malaysia 2019 car. This company car tax table shows the bik rate bands based on co2 emissions. Generally non cash benefits e g. Inland revenue board of malaysia benefits in kind public ruling no. 5 2019 inland revenue board of malaysia date of publication.

Medical dental benefits. How to work out the benefit of a company car 480. The formula method 6 2 1. Ya 2008 leave passages.

19 november 2019 4 2 perquisites are benefits in cash or in kind which are convertible into money received by an employee from his employer or from third parties in respect of having or exercising an employment. 12 december 2019 page 1 of 27 1. 19 benefits in kind exemptions. Be aware that the diesel non rde2 supplement is now 4 and is expected to still be applicable in 2020 21.

11 2019 date of publication. 2 2 however there are certain benefits in kind which are either exempted from tax or are. And one should also be awar. New computer broadband subscription wef.

Company car tax benefit in kind bik rates table 2019 20 to 2020 21. Objective the objective of this public ruling pr is to explain a the tax treatment in relation to benefit in kind bik received by an employee from his employer for exercising an employment and. Percentage rates for the tax year 2020 to 2021 have been added for petrol powered and hybrid powered cars. Within malaysia not exceeding three times in any calendar year up to ya 2006 within malaysia no limit wef.

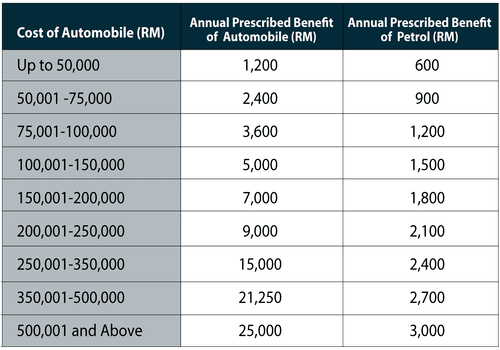

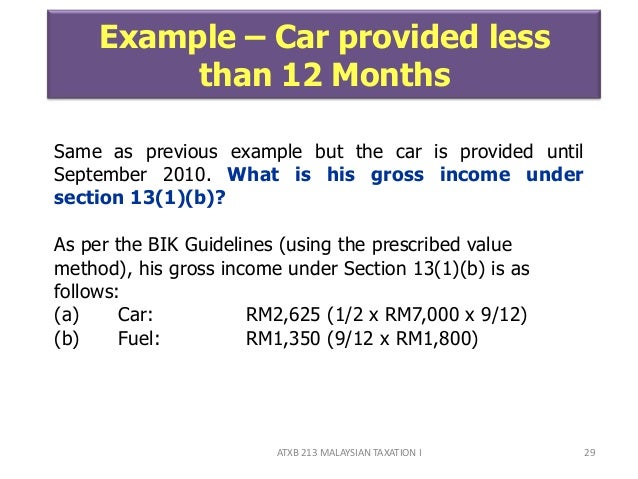

Tax exemption on benefits in kind received by an employee 2 1 benefits in kind received by an employee pursuant to his employment are chargeable to tax as part of gross income from employment under paragraph 13 1 b of the income tax act 1967 ita. 15 march 2013 pages 4 of 31 a the formula method and b the prescribed value method. Certain benefits in kind pertaining to consumable services are not eligible for taxation. Perquisites are taxable under paragraph.

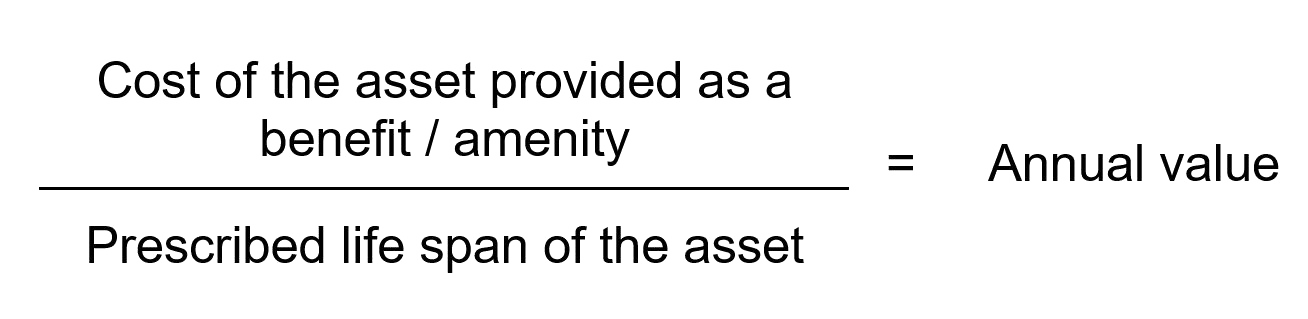

Inland revenue board of malaysia benefits in kind public ruling no. Under this method each benefit provided to the employee is ascertained by using the formula below. The remaining period from date of purchase to the expiry of the coe is 6 years 2 months. Examples of consumable services are dental care childcare benefits food drinks specially arranged transportation between pick up points and special discounts for consumable products that cannot be resold such as food or toiletries etc.

3 2013 date of issue. There are several tax rules governing how these benefits are valued and reported for tax purposes. Accommodation or motorcars provided by employers to their employees are treated as income of the employees.