Negative Impact Of Gst In Malaysia

In addition gst is a new form of broad based tax that will impact the majority of malaysians who are not the taxpayers now.

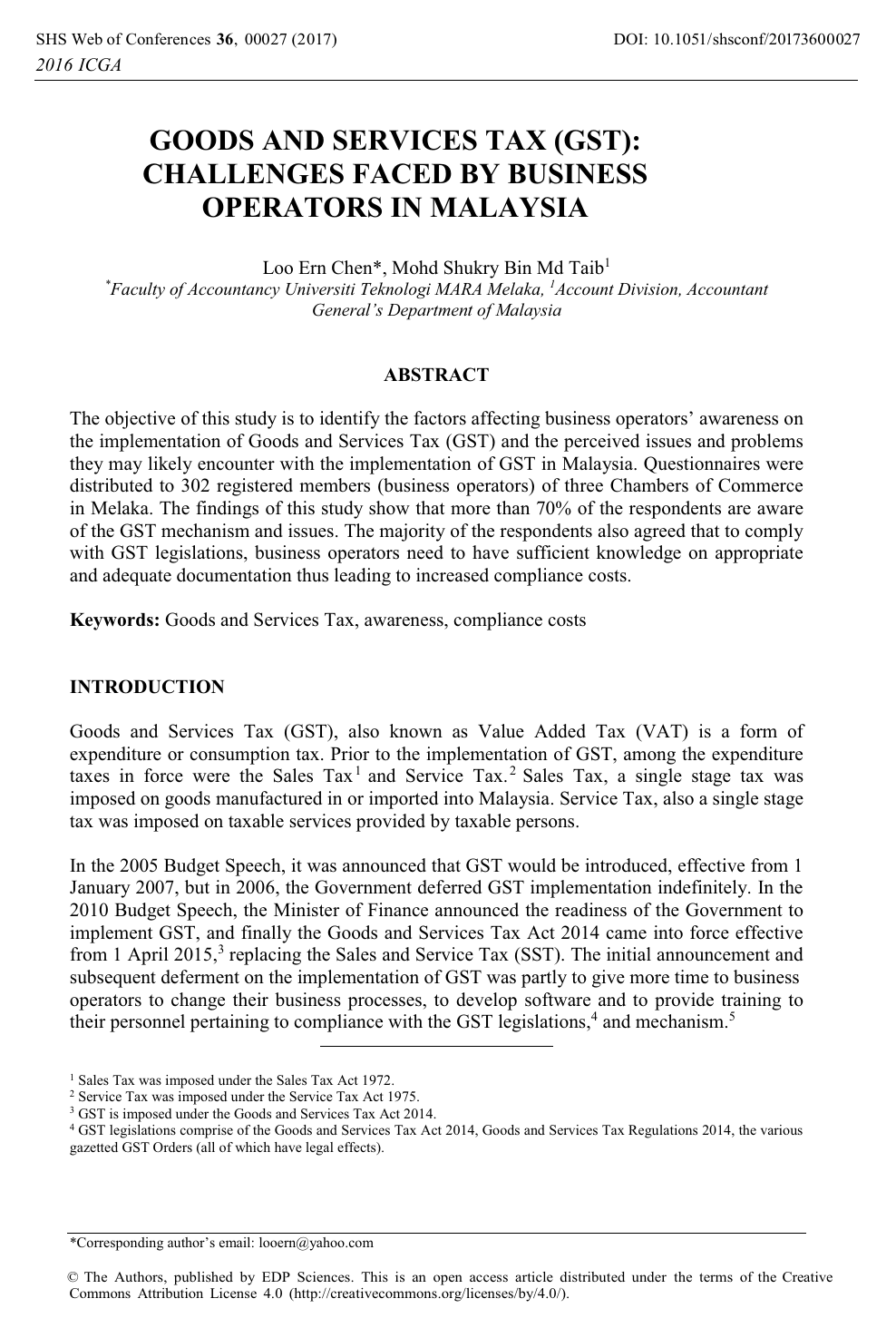

Negative impact of gst in malaysia. Malaysia s plan to remove the goods and services tax gst would be credit negative as it would increase the government s reliance on oil related revenue as well as narrow the tax base which would strain fiscal strength said moody s investors service today. Written by imoney editorial. Gst will not be imposed on piped water and first 200 units of electricity per month for domestic consumers and transportation services such as bus. Goods and services tax gst has been a controversial topic in malaysia when it was first implemented.

Currently sales tax and service tax rates are 10 and 6 respectively. 26 8 2013 16 17 impact on consumer price effects on consumers. 4 1 tangible effects of the gst sales sales the implantation of gst has affected the sales and marketing in any companies in malaysia. Kuala lumpur may 22.

Goods and services tax gst malaysia will be implemented with effective from 1 april 2015 and gst rate is fixed at 6 per cent. Based on the malaysian gst model the price effects are minimal due to. Gst is imposed on goods and services at every production and distribution stage in the supply chain including importation of goods and services. For example if my business gives customers 60 days to settle their invoices i still have to submit the gst on my sales at the end of the month.

The gst is basically a form of taxation system imposed by the government where there is a single tax in the economy that is placed upon goods and services offered. Gst impact last updated. Last wednesday the ministry of finance announced that the 6 gst would be void from june 1 and indicated. Sales tax and service tax will be abolished.

In recent times the goods and services tax gst has been the subject of heated debates by malaysians from all walks of life. While the experts and supporters lauded the positive wealth effect gst is expected to have on the country others questioned the potential impacts gst could have on the common folks. Basic and essential. Malaysians felt the sudden impact of gst because we started at 6 right away and our businesses had to foot a big gst bill upfront and then wait a few months to get paid.

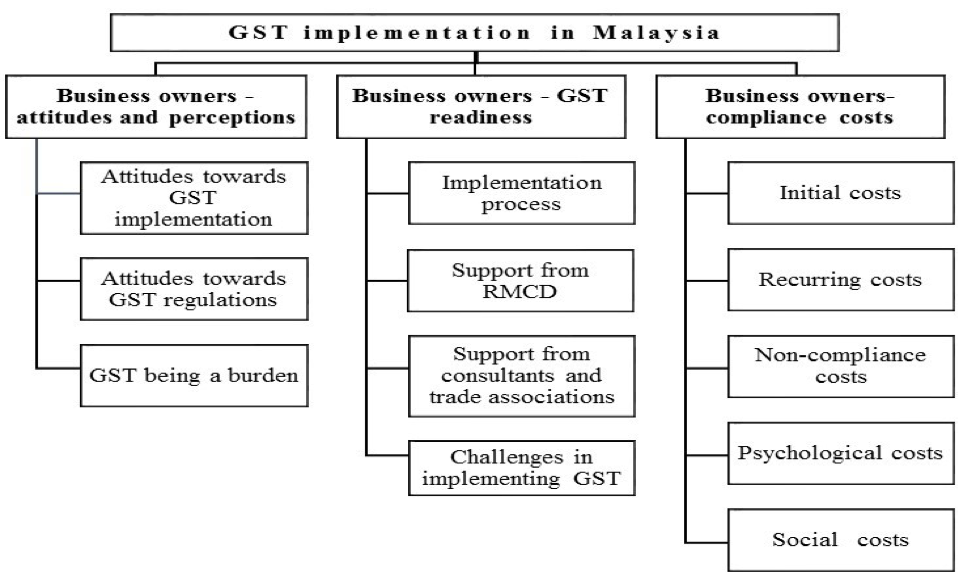

Although the government claims that the implementation of gst would not burden the people because the income tax rate is not increasing in fact the gst is increasing the burden of malaysians who are not the taxpayers now. This study examines the impact of the gst on the malaysian economy from three major perspectives. The sales tax was abolished and replaced by the 6 gst is a value added tax that is a tax paid on the value. The goods and services tax gst has been in effect for a while now in malaysia.

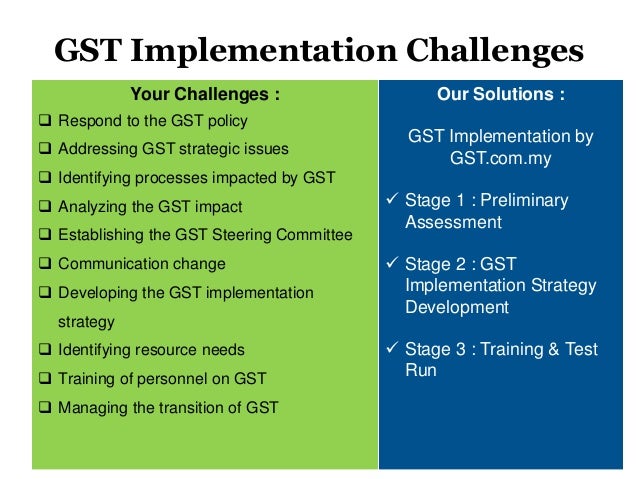

Gst being implemented by government since 1 st april 2015 and it caused. The advantages disadvantages of gst in malaysia.