Tenancy Agreement Stamp Duty Malaysia Lhdn

Who pays for the stamp duty tenant or landlord.

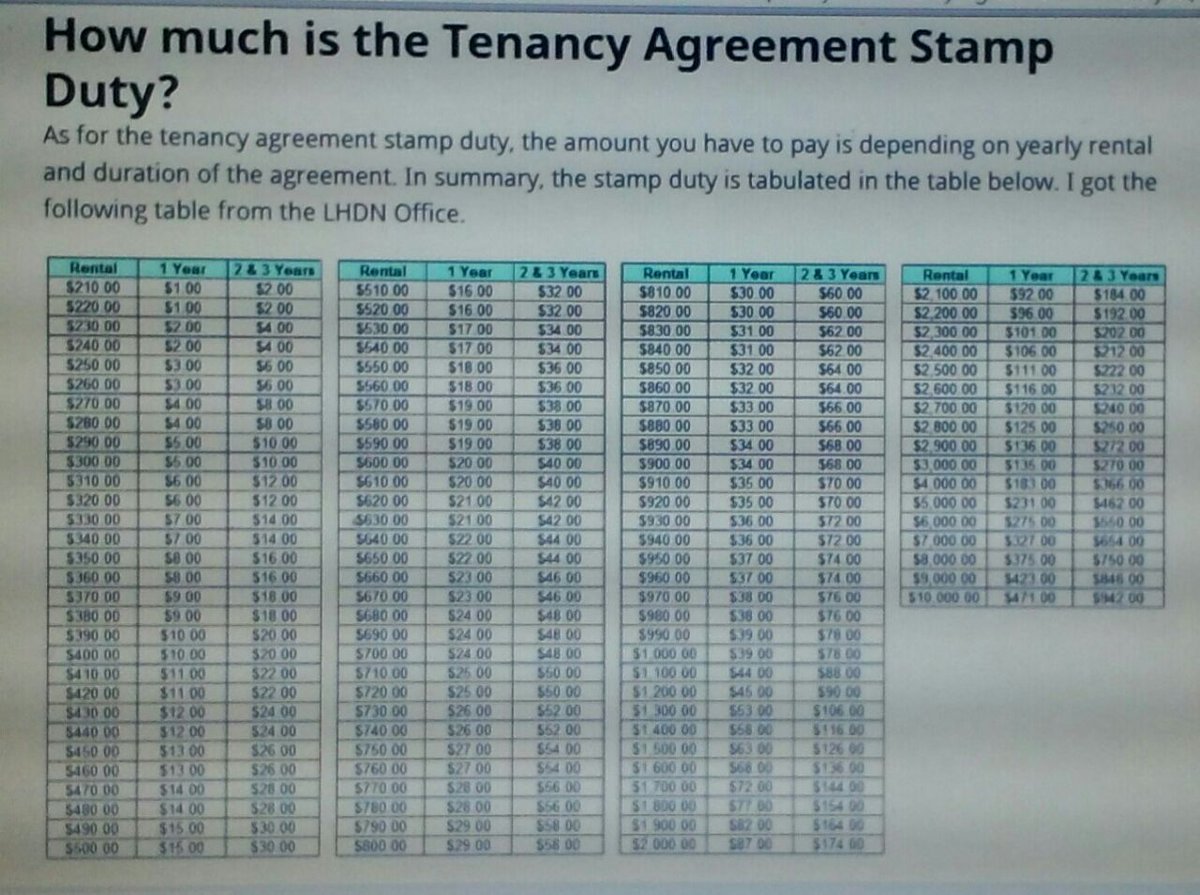

Tenancy agreement stamp duty malaysia lhdn. You can pay for stamp duty at any lembaga hasil dalam negeri lhdn in malaysia for a list of lhdn branches near you go here. The tenancy agreement will only be binding after it has been stamped by the stamp office. How much is the tenancy agreement stamp duty. There is no hard rule on this as the law doesn t state however conventionally it is the tenant who will bear the cost of stamping fee but some more desperate owner agree to split 50 50 or absorb the cost to secure.

Sekiranya terdapat sebarang pertanyaan tuan puan boleh menghubungi pejabat setem cawangan pusat khidmat hasil lhdnm yang berdekatan atau emel kepada stamps. Prepared two copies of tenancy agreement and duly signed by both tenant and landlord. In summary the stamp duty is tabulated in the table below. Go to your nearest lembaga hasil dalam negeri office which is the same place where we submit our income tax.

This is the second part of a four part series article to be used as a simple guide to tenancy agreements for landlords who wish to rent. Harini 15 nov baru sempat bawa agreement utk mati setem. Instruments liable to stamp duty are those listed in the first schedule of the stamp act 1949 exemptions relief from stamp duty general exemptions under section 35 in first schedule stamp act 1949 and specific exemptions under item 2 4 and 32 in first schedule stamp act 1949. But before it is sealed by lhdn you need pay the stamp duty.

Asalkan tarikh agreement tidak melebihi 60 hari dari tarikh nk matikan setem. Accordingly you will be asked by staff at the nearest lhdn office to submit two application forms pds 1 and pds 49 a. Saya baru ke lhdn. Agreement dibuat ditandatangan 8 okt.

How to stamp my tenancy agreement. Stamps is an electronic stamp duty assessment and payment system via internet. Stamp duty for tenancy agreement malaysia for lhdn usually the landlord will arrange for the stamping of the tenancy agreement. Basically the stamp duty for tenancy agreements spanning less than one year is rm1 for every rm250 of the annual rent in excess of rm2 400.

Penyewa masuk 1 okt. So far i have been only 3 lhdn offices namely. Alhamdulillah tiada penalti dikenakan.