Stamp Duty For Tenancy Agreement Malaysia 2020

Chat property malaysia author.

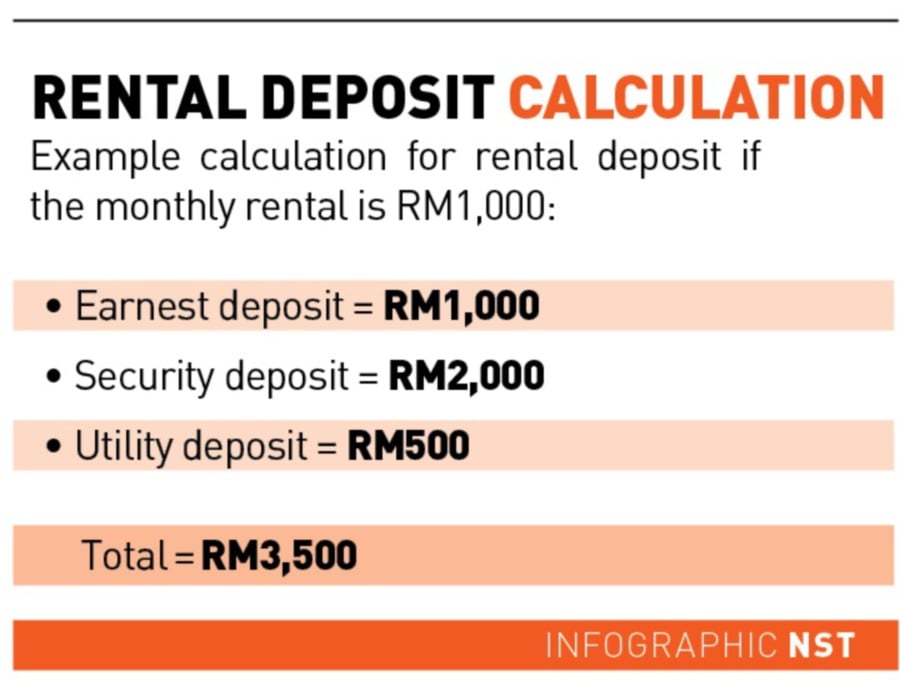

Stamp duty for tenancy agreement malaysia 2020. First rm 10 000 rental 50 of the monthly rent. Rm100 000 x 1 rm1000. In summary the stamp duty is tabulated in the table below. Stamp duty exemption on contract notes for sale and purchase transaction of shares of a medium and small capital company in bursa malaysia.

April 17 2019 at 4 01 pm. Return form rf filing programme for the year 2020. Tenancy agreement legal fee and stamp duty calculation in malaysia november 6 2019 august 17 2020 alicia 2 comments charges kuala lumpur malaysia tenancy agreement tenancy agreement is very important for both of the landlord and tenant. To know how much down payment lawyer fees and stamp duty needed are so.

Above table listed are for the main copy of tenancy agreement if you have 2nd or 3rd duplicate copy the. Stamps is an electronic stamp duty assessment and payment system via internet. About chat property malaysia. From rm100 001 to rm200 000 2 rm200 000 x 2 rm4 000.

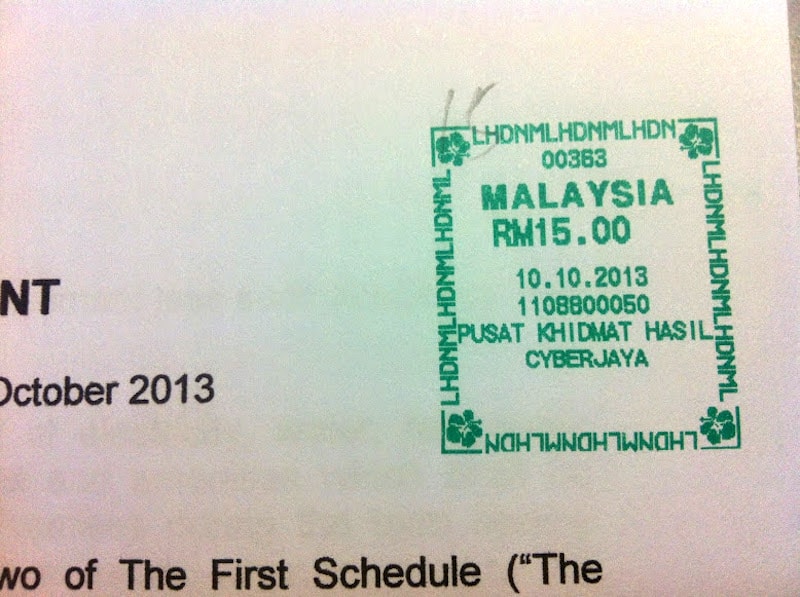

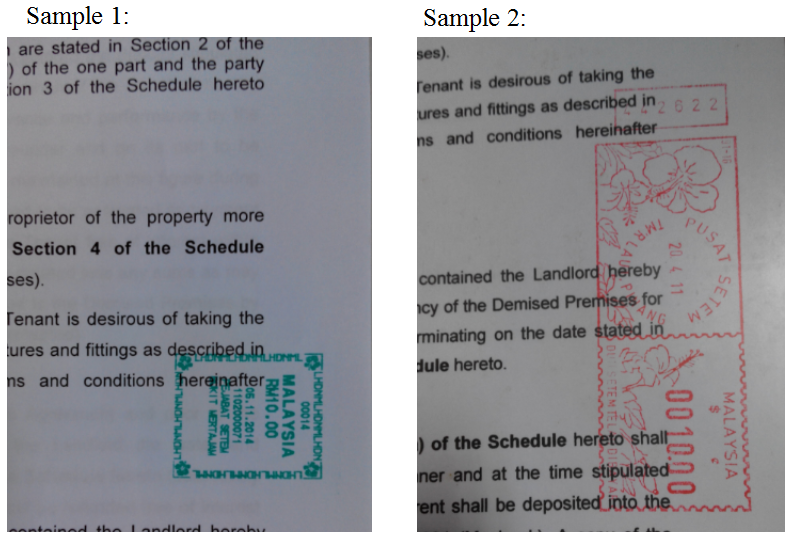

Legal fee for tenancy agreement period of above 3 years. Return form rf filing programme for the year 2020 amendment 1 2020. All instruments chargeable with duty and executed by any person in malaysia shall be brought to the collector who shall assess the duty chargeable. Stamp duty exemption on the instruments of transfer and loan agreement for the purchase of residential homes priced between rm300 000 to rm2 5 million subject to at least 10 discount provided by the developer.

The standard stamp duty chargeable for tenancy agreement are as follows. Purchasing and hunting for a house can be an exciting and stressful experience. Next rm 90000 rental 20 of the monthly rent. Tenant period is start from june 2019 till june 2020 may i write date of tenancy at 15th apr 2019 and go for stamping on apr 19.

I got the following table from the lhdn office. Stamp duty calculation malaysia 2020 stamp duty exemption malaysia 2020 the first example if the property purchase price or property value is rm300 000 the property stamp duty will be as follows. Stamp duty exemption on contract notes for sale and purchase transaction of structured warrant or exchange traded fund approved by the securities commission executed from 1 january 2018 to 31 december 2020. Chat property malaysia.

Stamp duty an instrument may be. For the first rm100 000 1. How do i calculate the stamp duty payable for the tenancy agreement. Total stamp duty is rm5000.

For some people buying a home is a significant milestone that tops many people s lifetime to do lists. The exemption on the instrument of transfer is limited to the first rm1 million of the property price while full stamp duty exemption is given on loan agreement. More than rm 100 000 negotiable q. Legal fees stamp duty calculation 2020 when buying a house in malaysia.