Private Exempt Company Malaysia

Profit and loss account includes income and expenditure account revenue account or any other account showing the results of the business of a corporation for a period.

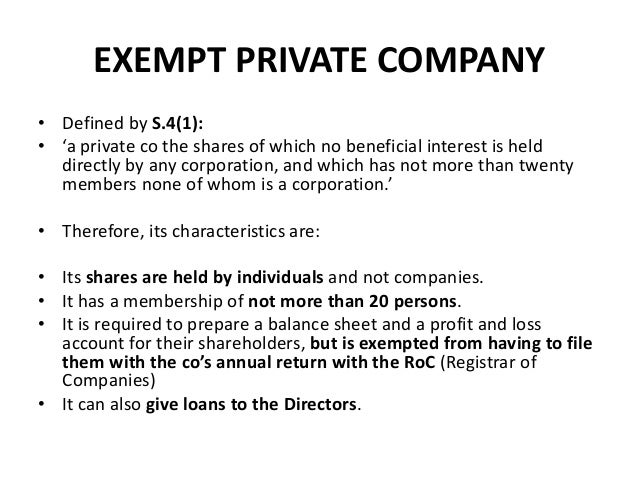

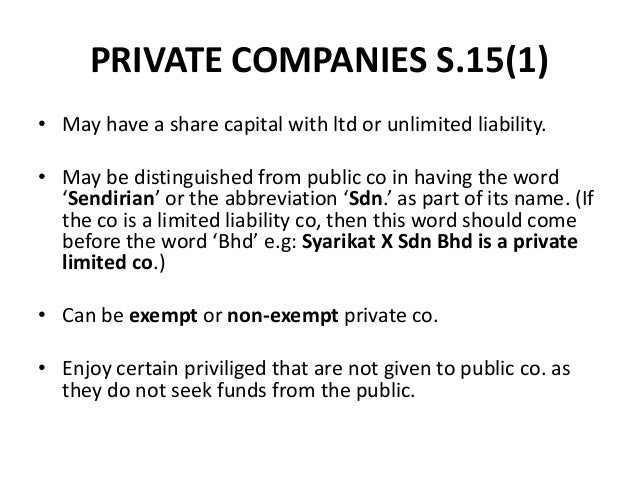

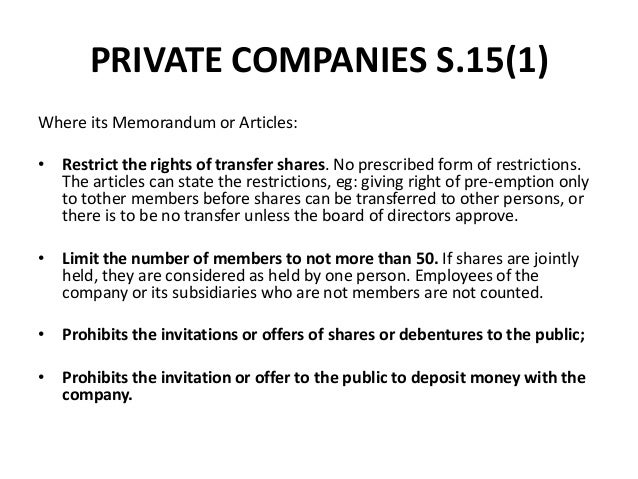

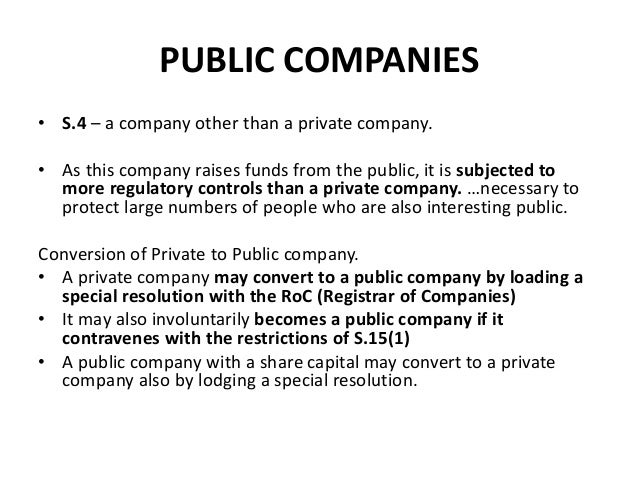

Private exempt company malaysia. Earlier a private company was prohibited by the section 163 of companies act to offer security guarantee against any loan or a loan to any other company in which its directors have interest more than twenty percent. Where beneficial interest of shares in the company are not held directly or indirectly by any corporation ie. Exempt private company in malaysia. Which has not more than 20 members none of whom is a corporation.

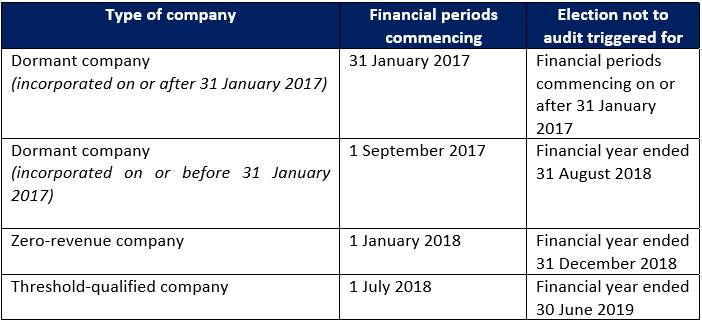

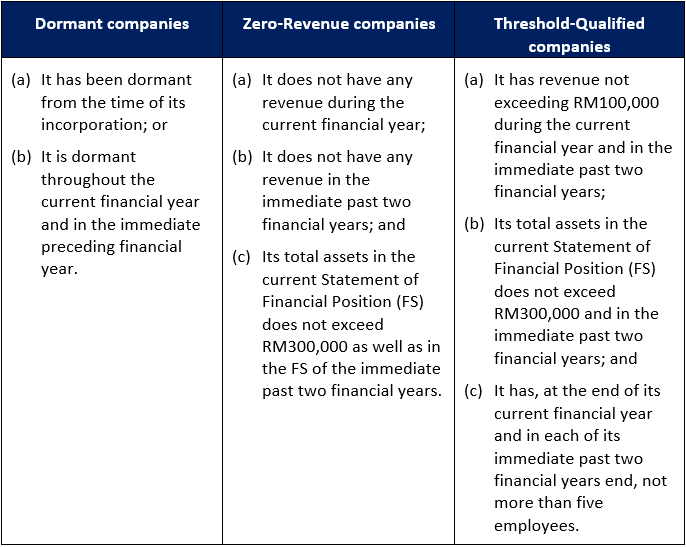

Exempt private companies are independent in regard to the guarantee for the internal company loans to its directors. Issued pursuant to section 20c of the companies commission of malaysia act 2001 and subsection 267 2 of the companies act 2016 ca 2016 this practice directive rolls out the qualifying criteria for private companies from having to appoint an auditor in a financial year i e. However an exempt private company needs to file with ccm a certificate that is signed by the director of the company the secretary and the auditor of the company stating that.