Partnership Tax Computation Malaysia

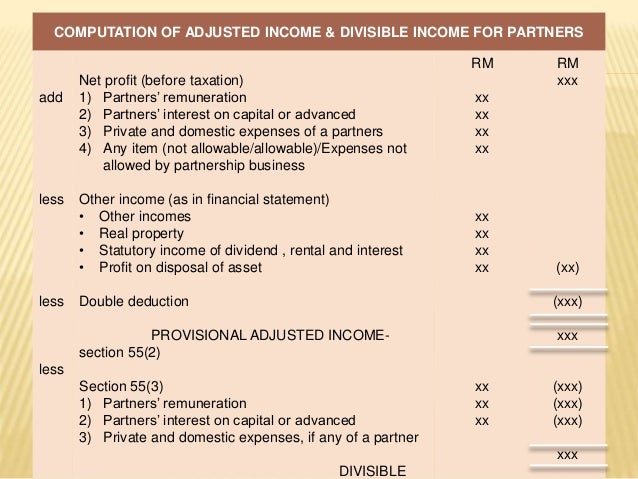

Tax computation starts from your business income statement that has been prepared in accordance with malaysia accounting standard.

Partnership tax computation malaysia. Bilateral credit and unilateral. Melayu malay 简体中文 chinese simplified taxation for limited liability partnership llp in malaysia. 2link dot com view my complete profile. A foreign llp that expands its business activities to malaysia must register with the ccm under the llpa 2012.

For a company an audited report must be available before the computation of tax. Partnership tax computation monday february 1 2010. As a general rule of thumb if both spouses are earning high incomes in the year of assessment it is always recommended to opt for separate assessment to leverage on the tax reliefs and deductibles available. Posted by 2link dot com at 6 57 pm no comments.

This page is also available in. Partnership tax comp slide no. Posts atom 2link back to. The residence status of a foreign llp is determined by.

Blog archive 2010 1 february 1 partnership tax comp slide no. Malaysia offers a tax friendly environment with significantly low income tax the incomes are earned by the individuals and not by the partnership. Tax computation for partnership january 2 2009 5 december 1 november 4 about me. 10 tax treatment of a limited liability partnership 7 11.

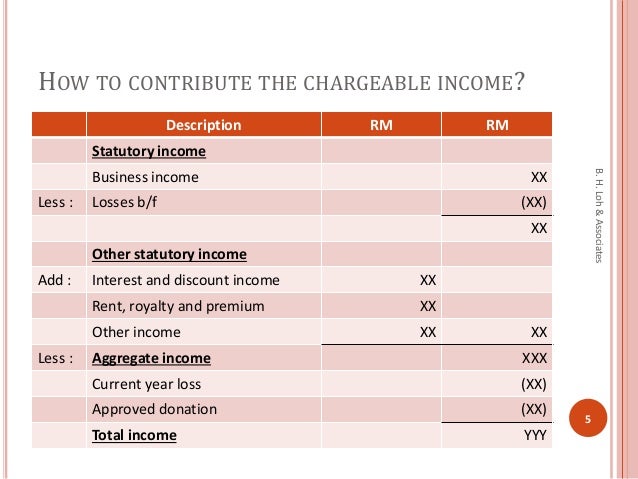

Any dividends distributed by the company will be exempt from tax in the hands of the shareholders. Company while registered companies are subject to corporate tax other types of businesses such as sole proprietorships and partnerships are also liable to income tax. Tax treatment of partners of a limited liability partnership 17 12. The last date for submission of form b and p is 30th june.

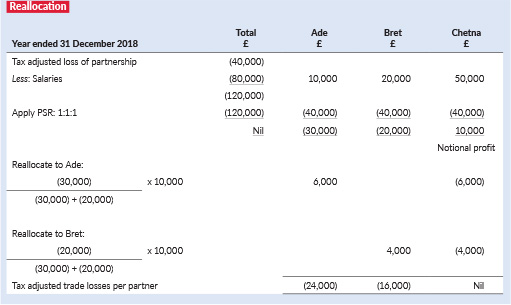

Under the single tier system income tax payable on the chargeable income of a company is a final tax in malaysia. According to section 45 of malaysia s income tax act 1967 all married couples in malaysia have the right to choose whether to file individual or joint taxes. Tax treatment of llp. Therefore the partners are liable for their profits under personal income tax regulations the partners are taxed on their chargeable income at rates ranging from 2 to 26 after the deduction of tax relief.

%202.png)