Partnership Tax Computation Format Malaysia

Posted by 2link dot com at 6 57 pm no comments.

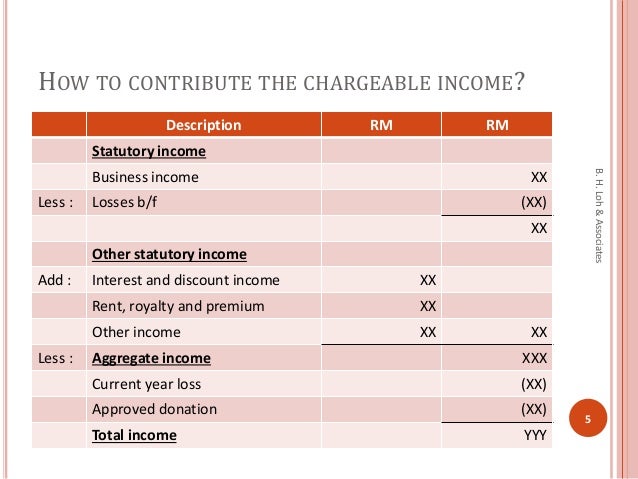

Partnership tax computation format malaysia. For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. All supporting documents like business records cp30 and receipts need not be submitted with form p. Keep all business records supporting documents for deductions reliefs and rebate for a period of 7 years. Tax adjustments include non deductible expenses non taxable receipts further deductions and capital allowances.

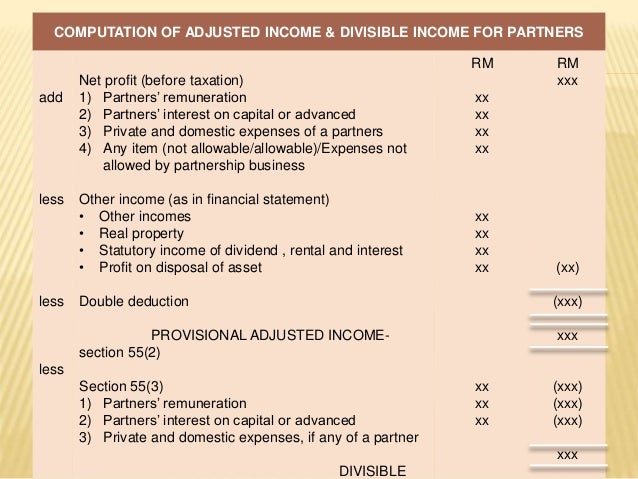

Business records include profit and loss account balance sheet sales records. These tax incentives appear in various forms such as exemption on income extra allowances on capital expenditure incurred double deduction of expenses special deduction of expenses preferential tax treatments for promoted sectors exemption of import duty and excise duty etc. Therefore the partners are liable for their profits under personal income tax regulations the partners are taxed on their chargeable income at rates ranging from 2 to 26 after the deduction of tax relief. Tax treatment of llp.

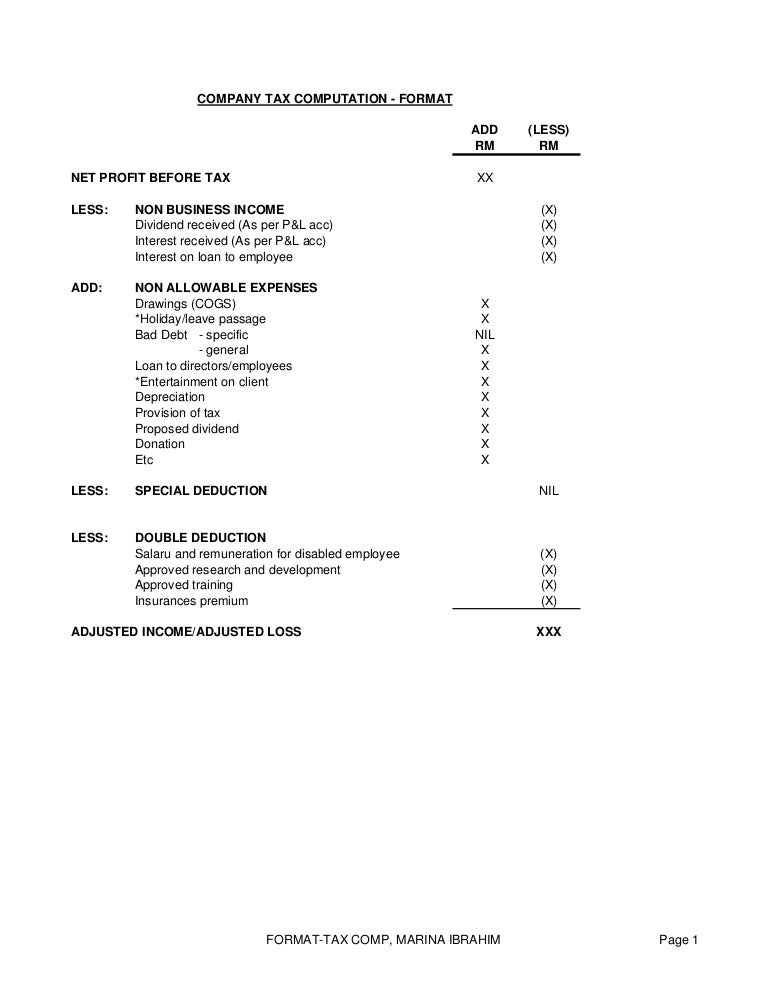

Non business income x dividend received as per p l acc x interest received as per p l acc x interest on loan to employee x add. Llp have a similar tax treatment like company where chargeable income from llp will be taxed at the llp level at tax rate of 24 generally. Partnership tax computation monday february 1 2010. The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing.

Malaysia offers a tax friendly environment with significantly low income tax the incomes are earned by the individuals and not by the partnership. Company while registered companies are subject to corporate tax other types of businesses such as sole proprietorships and partnerships are also liable to income tax. Blog archive 2010 1 february 1 partnership tax comp slide no. Posts atom 2link back to.

Corporate income tax in malaysia is applicable to both resident and non resident companies. Example of tax computation format would be. The tax rate for sole proprietorship or partnership will follow the tax rate of an individual. For partnerships income is distributed to partners for individual tax computation sole proprietorship partnership vs.

To submit the income tax return form by the due date. A tax computation is a statement showing the tax adjustments to the accounting profit to arrive at the income that is chargeable to tax. Partnership tax comp slide no. Non allowable expenses drawings cogs x holiday leave passage x bad debt specific nil general x loan to directors employees x.

Tax rate of company. This page is also available in.

%202.png)