Corporate Tax In Malaysia

Interest paid to a non resident by a bank or a finance company in malaysia is exempt from tax.

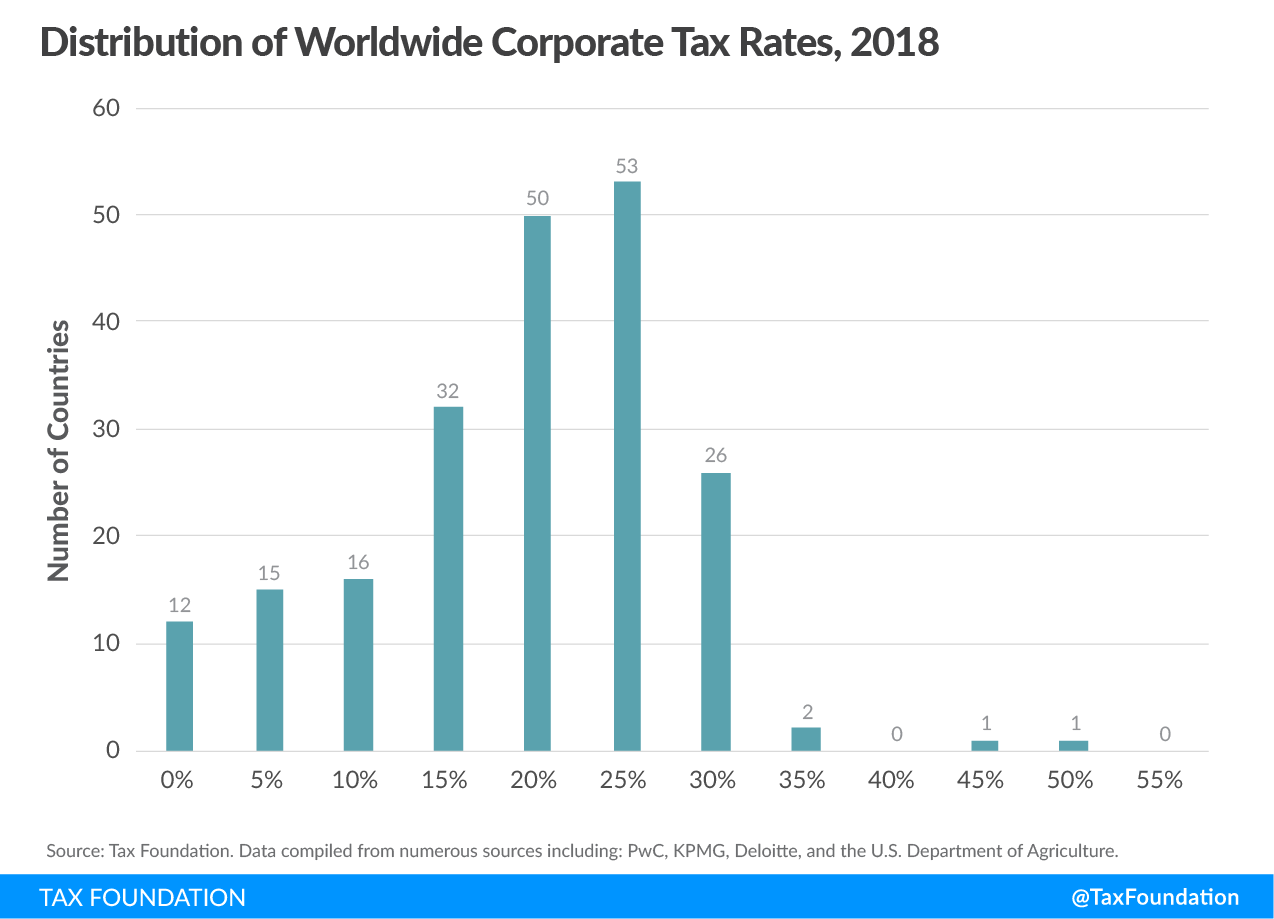

Corporate tax in malaysia. Hasil care line 03 8911 1000 603 8911 1100 luar negara waktu operasi. This publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practices. Malaysia adopts a territorial system of income taxation. Corporate tax rate in malaysia averaged 26 21 percent from 1997 until 2020 reaching an all time high of 30 percent in 1997 and a record low of 24 percent in 2015.

These proposals will not become law until their enactment and may be amended in the course of their passage through. No tax is withheld on transfer of profits to a foreign head office. This booklet also incorporates in coloured italics the 2020 malaysian budget proposals announced on 11 october 2019 and the finance bill 2019. Corporate taxes on corporate income last reviewed 01 july 2020 for both resident and non resident companies corporate income tax cit is imposed on income accruing in or derived from malaysia.

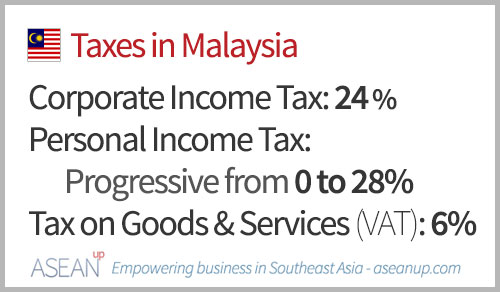

Only services rendered in malaysia are liable to tax. A company whether resident or not is assessable on income accrued in or derived from malaysia. The corporate tax rate in malaysia stands at 24 percent. This tax is imposed on income that is derived from or accruing in the country both in the case of resident and non resident legal entities.

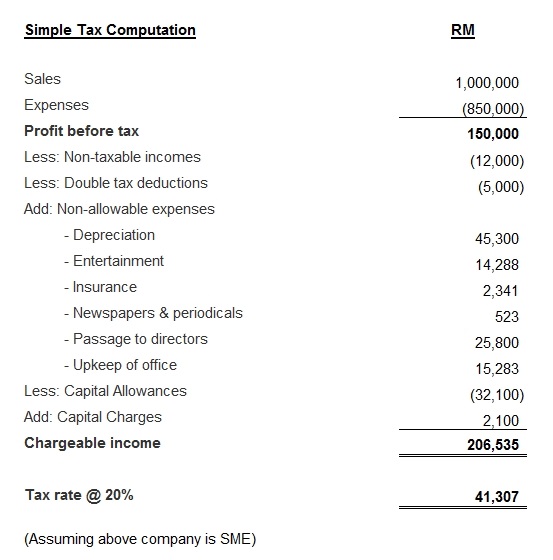

Isnin hingga jumaat 9 00 am hingga 5 00 pm. Corporate other taxes. The malaysia corporate tax rate has a standard rate as well as a smaller one applicable under certain conditions to small and medium resident companies. Tax rates on branch profits of a company are the same as cit rates.

Income derived from sources outside malaysia and remitted by a resident company is exempted from tax. We simplify finance and compliance operations from accounting company secretary payroll llp incorporation and tax services in kuala lumpur selangor johor and sabah. Malaysia corporate branch income last reviewed 01 july 2020. This page provides malaysia corporate tax rate actual values historical data forecast chart statistics economic calendar and news.

Malaysia corporate income tax rate. However from 17 january 2017 to 5 september 2017 services rendered in and outside malaysia are liable to tax.